Portfolios

The portfolio functionality of the Upvest Investment API enables you to set up, manage and invest in portfolios as a combination of different instruments. Besides configuring and customising portfolios, you can also set up recurring rebalancing strategies, trigger one-off rebalancings, and create portfolio savings plans.

Upvest supports a setup with multiple portfolios.

This feature will be activated for you on request. Please contact us if you are interested.

In this guide and the following pages we'll introduce the key entities and processes involved in our portfolios. For a walk-through of the steps to enable portfolio functionality in your solution see our "Enabling portfolio investments" section.

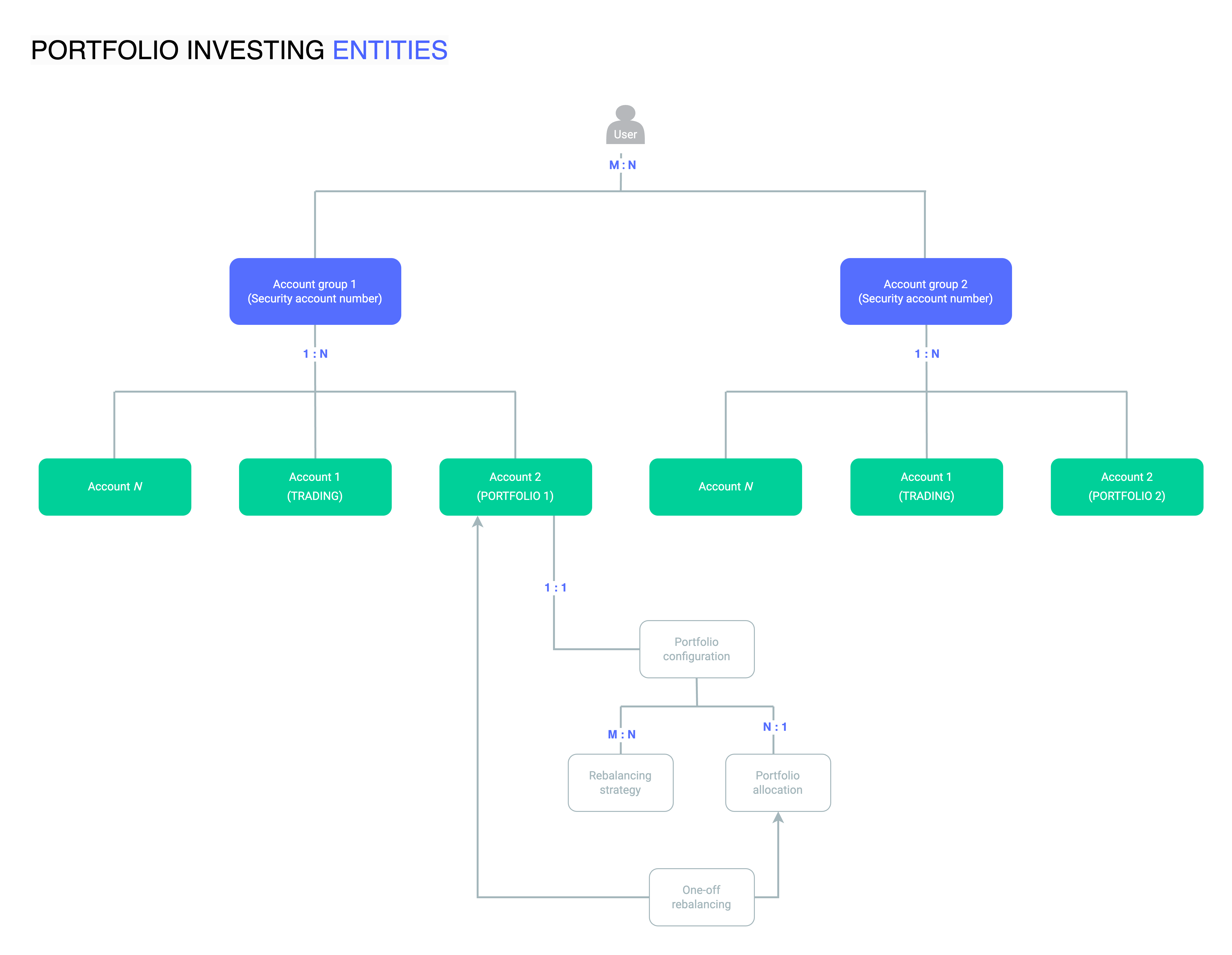

Key entities

Portfolio investing in the Investment API focuses on a small number of key entities.

Portfolio allocation

A portfolio allocation represents the investment objective of the portfolio manager, or the user who created it; ESG, Tech, crypto, emerging markets, etc.

It is defined by a list of instruments and their relative weights. The allocation determines how the user’s money should be invested in the market by denoting a target state for a user’s portfolio investment.

Portfolio account

A portfolio account holds the user’s portfolio investments. The account contains all the individual positions that make up the user’s portfolio. The individual positions are directly derived from the portfolio allocation within this specific portfolio's configuration.

Portfolio configuration

A portfolio configuration is the entity through which a user's portfolio investment is set up and managed. To configure a portfolio investment, you specify a portfolio allocation and, optionally, a rebalancing strategy. After you create a portfolio configuration for an account, money residing in that account will be invested and managed according to the specified allocation and optionally by a rebalancing strategy.

Rebalancing strategy

A rebalancing strategy defines how the user's portfolio investment is brought to the defined target allocation. A rebalancing strategy automatically triggers a rebalancing of the user's portfolio investments based on the conditions you define. For example, the conditions could be time-based (i.e. once a year), or threshold-based (i.e. percentage deviation of a position from the defined target allocation).

One-off rebalancing

A one-off rebalancing trigger allows you or your users to initiate an immediate rebalancing of one or more portfolio investments at any time. This allows you to quickly react to changing market conditions.

Portfolio marketplace

Together, these entities allow you to build dynamic investment strategies and tailor portfolios to your own capital market assumptions. In addition, you can allow your users to configure their own portfolios, tailored to each user’s specific needs and investment preferences. Finally, any portfolio created by a user can be shared and copy-traded across the platform, enabling a marketplace for portfolio ideas.