Use Cases

In this section we will show you how Upvest handles a tax exemption request via the Investment API.

Process workflow

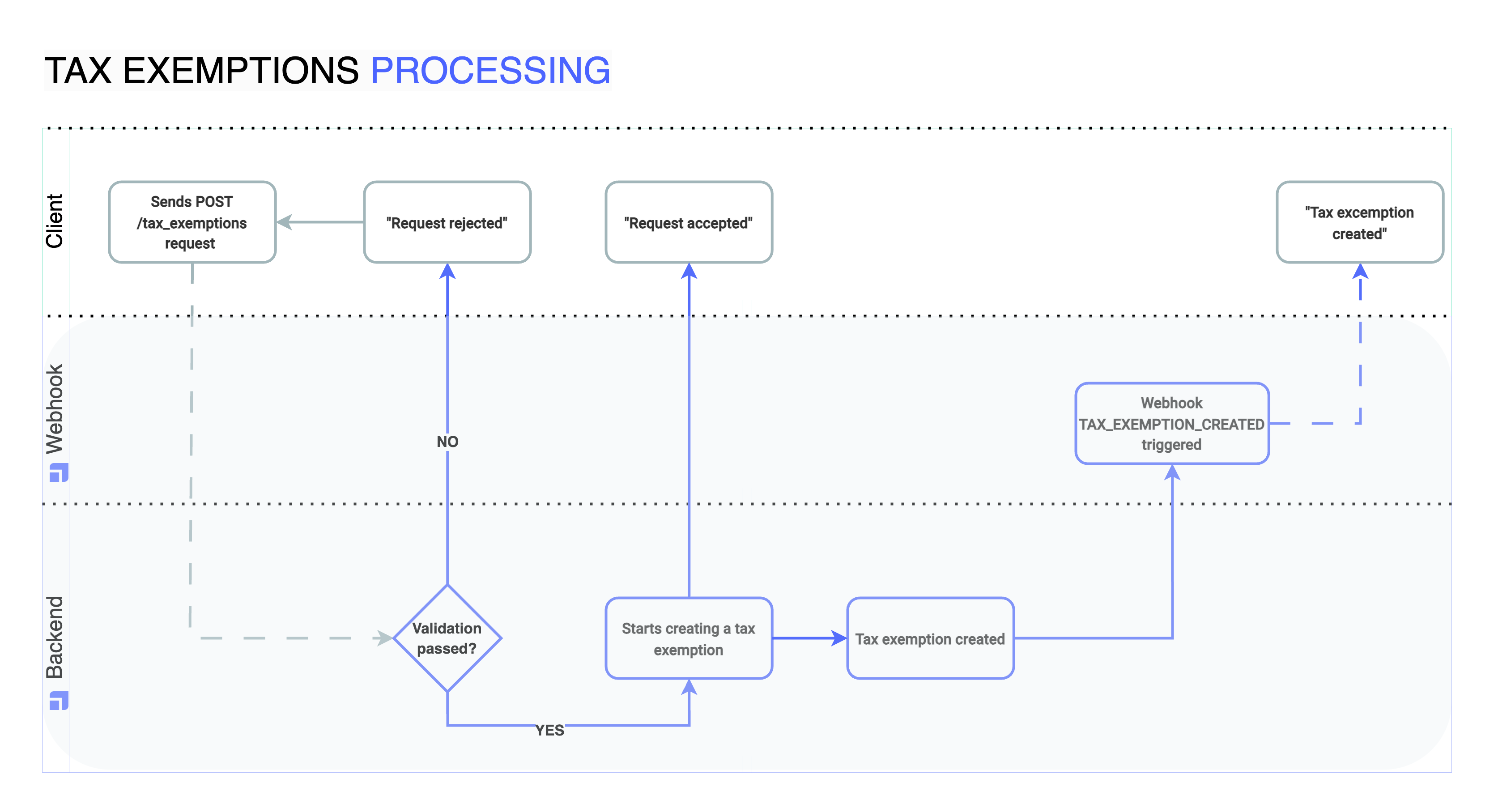

In general, all tax exemption requests will return a response that indicates whether the request has been accepted for processing. The final result of the processing is returned asynchronously. Each HTTP response contains the ID of the tax exemption.

The following diagram illustrates the individual steps in the process.

Tax exemption status

As a rule, tax exemptions follow these states in the API:

| Status | Description |

|---|---|

NEW | The user has applied for a tax exemption. The validity of the tax exemption has not yet been determined. |

ACTIVE | The tax exemption has been successfully created in the tax system and all current tax-relevant transactions take the new tax exemption into account. |

EXPIRED | The tax exemption is no longer ACTIVE and the valid_to_date already lies in the past. An update is not possible. |

CANCELLED | The tax exemption could not be created in the tax system. This is a definitive status, i.e. clients need to file another tax exemption. |

If the status of a tax exemption order changes, webhooks are triggered accordingly. To receive webhook updates, the user of the API must subscribe to the corresponding webhooks. Go to our API reference to learn how to subscribe to webhooks.

Next steps

Now let's implement tax exemptions in the Investment API platform!