Virtual cash use cases

This section provides you with some simplified example use cases to help you better understand the processes of virtual cash management.

The examples show which steps the participants - end user, client and Upvest - carry out at which point in time and indicate the respective availability of the virtual cash balance at the different stages.

Virtual cash balance

The following diagrams show you how the virtual cash balances are affected by each step in the use case. You can see when a virtual cash is available, for which processes it is available and also which actions influence the balance. This table describes the different types of virtual cash balance that are referenced in the diagrams.

| Virtual cash balance | Description |

|---|---|

| Balance | Total virtual balance of the user account, including cash blocked for trading and outstanding settlement. |

| Availability for withdrawal | Total amount of cash for settled orders as well as cash that has been virtually topped up by the client. May become negative for consecutive sell and buy orders. |

| Availability for trading | Virtual cash balance for the total amount of cash that can be used for the purchase of securities, including cash that has not yet been settled. |

| Pending settlement | Cash available to the user for further orders but not yet settled. |

| Locked for trading | Cash that has been blocked for orders that are being processed. |

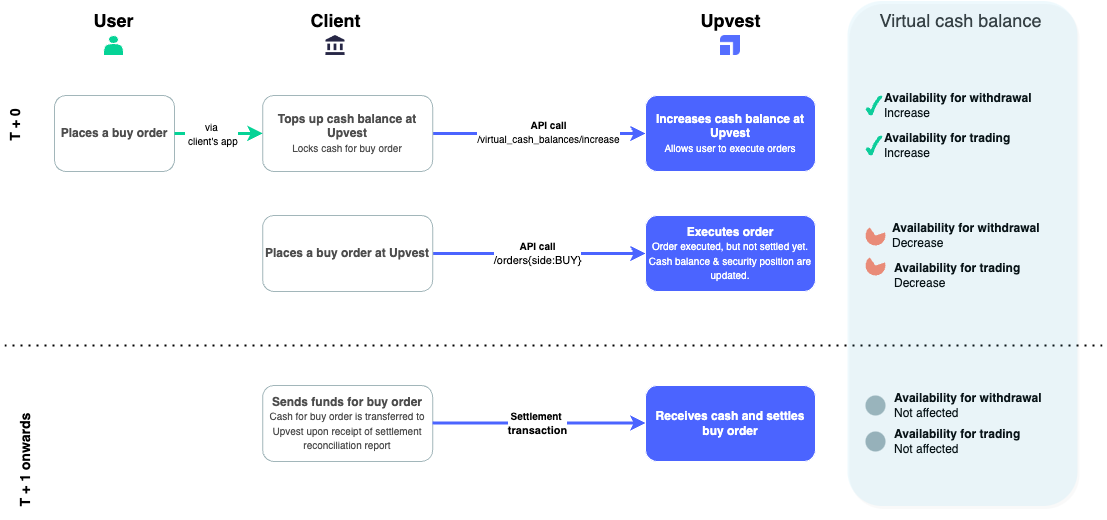

Buy order example

This diagram shows how a workflow looks like when the end user places a buy order.

In the Implementing virtual cash section you can learn how to use the Investment API to implement a virtual cash increase.

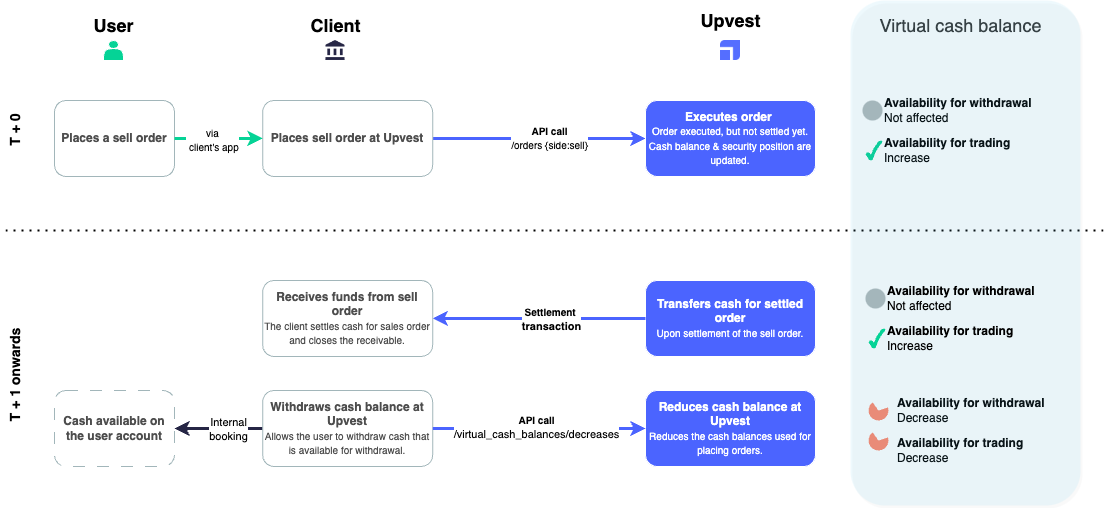

Sell order example

This diagram shows how a workflow looks like when the end user places a sell order.

In the Implementing virtual cash section you can learn how to use the Investment API to implement a virtual cash decrease.

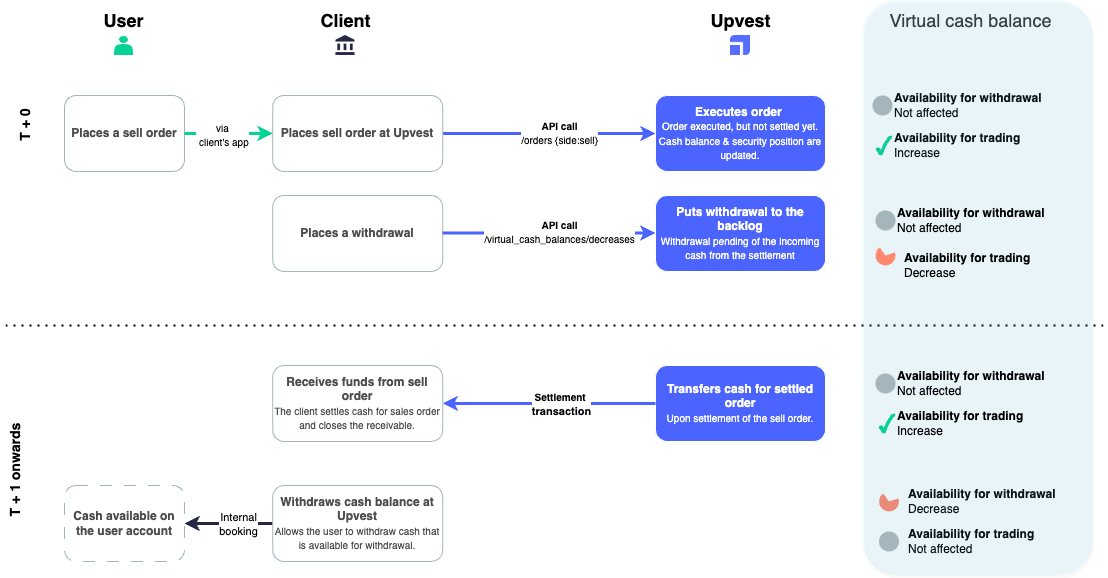

Sell order with withdrawal example